# PitchLense MCP - Professional Startup Risk Analysis Package

[](https://www.python.org/downloads/)

[](https://pitchlense-mcp.readthedocs.io/)

[](https://opensource.org/licenses/MIT)

[](https://pypi.org/project/pitchlense-mcp/)

[](https://github.com/connectaman/Pitchlense-mcp/actions)

🏆 **WINNER** !!! of **Google Cloud Gen AI Exchange Hackathon** under the problem statement “AI Analyst for Startup Evaluation.” 🏆

Competing among 278,000+ participants and 180,000+ teams nationwide

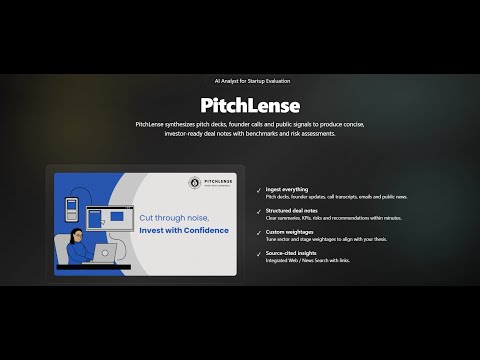

A comprehensive Model Context Protocol (MCP) package for analyzing startup investment risks using AI-powered assessment across multiple risk categories. Built with FastMCP and Google Gemini AI.

PitchLense is a comprehensive AI-powered startup analysis platform that provides detailed risk assessment and growth potential evaluation for early-stage ventures. The platform analyzes multiple dimensions of startup risk and provides actionable insights for investors, founders, and stakeholders.

## 🔗 Quick Links

- Website Link : https://www.pitchlense.com

- Web App Github Repo: https://github.com/connectaman/PitchLense

<div align="center">

[](https://youtu.be/HQrLTwL4aA0)

[](https://www.pitchlense.com/)

[](https://github.com/connectaman/PitchLense)

[](https://github.com/connectaman/Pitchlense-mcp)

[](https://pypi.org/project/pitchlense-mcp/)

[](https://pitchlense-mcp.readthedocs.io/en/latest/api.html)

</div>

### 📖 How to Use PitchLense

Watch our comprehensive tutorial video to learn how to use PitchLense effectively:

[](https://youtu.be/HQrLTwL4aA0)

**Click the image above to watch the tutorial on YouTube**

## 🚀 Features

### Individual Risk Analysis Tools

- **Market Risk Analyzer** - TAM, growth rate, competition, differentiation

- **Product Risk Analyzer** - Development stage, market fit, technical feasibility, IP protection

- **Team Risk Analyzer** - Leadership depth, founder stability, skill gaps, credibility

- **Financial Risk Analyzer** - Metrics consistency, burn rate, projections, CAC/LTV

- **Customer Risk Analyzer** - Traction levels, churn rate, retention, customer concentration

- **Operational Risk Analyzer** - Supply chain, GTM strategy, efficiency, execution

- **Competitive Risk Analyzer** - Incumbent strength, entry barriers, defensibility

- **Legal Risk Analyzer** - Regulatory environment, compliance, legal disputes

- **Exit Risk Analyzer** - Exit pathways, sector activity, late-stage appeal

### Comprehensive Analysis Tools & Data Sources

- **Comprehensive Risk Scanner** - Full analysis across all risk categories

- **Quick Risk Assessment** - Fast assessment of critical risk areas

- **Peer Benchmarking** - Compare metrics against sector/stage peers

- **SerpAPI Google News Tool** - Fetches first-page Google News with URLs and thumbnails

- **Perplexity Search Tool** - Answers with cited sources and URLs

## 📊 Risk Categories Covered

| Category | Key risks |

| --- | --- |

| Market | Small/overstated TAM; weak growth; crowded space; limited differentiation; niche dependence |

| Product | Early stage; unclear PMF; technical uncertainty; weak IP; poor scalability |

| Team/Founder | Single-founder risk; churn; skill gaps; credibility; misaligned incentives |

| Financial | Inconsistent metrics; high burn/short runway; optimistic projections; unfavorable CAC/LTV; low margins |

| Customer & Traction | Low traction; high churn; low retention; no marquee customers; concentration risk |

| Operational | Fragile supply chain; unclear GTM; operational inefficiency; poor execution |

| Competitive | Strong incumbents; low entry barriers; weak defensibility; saturation |

| Legal & Regulatory | Grey/untested areas; compliance gaps; disputes; IP risks |

| Exit | Unclear pathways; low sector exit activity; weak late‑stage appeal |

## 🛠️ Installation

### From PyPI (Recommended)

```bash

pip install pitchlense-mcp

```

### From Source

```bash

git clone https://github.com/pitchlense/pitchlense-mcp.git

cd pitchlense-mcp

pip install -e .

```

### Development Installation

```bash

git clone https://github.com/pitchlense/pitchlense-mcp.git

cd pitchlense-mcp

pip install -e ".[dev]"

```

## 🔑 Setup

### 1. Get Gemini API Key

1. Visit [Google AI Studio](https://makersuite.google.com/app/apikey)

2. Create a new API key

3. Copy the API key

### 2. Create .env

```bash

cp .env.template .env

# edit .env and fill in keys

```

Supported variables:

```

GEMINI_API_KEY=

SERPAPI_API_KEY=

PERPLEXITY_API_KEY=

```

## 🚀 Usage

### Command Line Interface

#### Run Comprehensive Analysis

```bash

# Create sample data

pitchlense-mcp sample --output my_startup.json

# Run comprehensive analysis

pitchlense-mcp analyze --input my_startup.json --output results.json

```

#### Run Quick Assessment

```bash

pitchlense-mcp quick --input my_startup.json --output quick_results.json

```

#### Start MCP Server

```bash

pitchlense-mcp server

```

### Python API

#### Basic Usage (single text input)

```python

from pitchlense_mcp import ComprehensiveRiskScanner

# Initialize scanner (reads GEMINI_API_KEY from env if not provided)

scanner = ComprehensiveRiskScanner()

# Provide all startup info as one organized text string

startup_info = """

Name: TechFlow Solutions

Industry: SaaS/Productivity Software

Stage: Series A

Business Model:

AI-powered workflow automation for SMBs; subscription pricing.

Financials:

MRR: $45k; Burn: $35k; Runway: 8 months; LTV/CAC: 13.3

Traction:

250 customers; 1,200 MAU; Churn: 5% monthly; NRR: 110%

Team:

CEO: Sarah Chen; CTO: Michael Rodriguez; Team size: 12

Market & Competition:

TAM: $12B; Competitors: Zapier, Power Automate; Growth: 15% YoY

"""

# Run comprehensive analysis

results = scanner.comprehensive_startup_risk_analysis(startup_info)

print(f"Overall Risk Level: {results['overall_risk_level']}")

print(f"Overall Risk Score: {results['overall_score']}/10")

print(f"Investment Recommendation: {results['investment_recommendation']}")

```

#### Individual Risk Analysis (text input)

```python

from pitchlense_mcp import MarketRiskAnalyzer, GeminiLLM

# Initialize components

llm_client = GeminiLLM(api_key="your_api_key")

market_analyzer = MarketRiskAnalyzer(llm_client)

# Analyze market risks

market_results = market_analyzer.analyze(startup_info)

print(f"Market Risk Level: {market_results['overall_risk_level']}")

```

### MCP Server Integration

The package provides a complete MCP server that can be integrated with MCP-compatible clients:

```python

from pitchlense_mcp import ComprehensiveRiskScanner

# Start MCP server

scanner = ComprehensiveRiskScanner()

scanner.run()

```

## 📋 Input Data Format

The primary input is a single organized text string containing all startup information (details, metrics, traction, news, competitive landscape, etc.). This is the format used by all analyzers and MCP tools.

Example text input:

```

Name: AcmeAI

Industry: Fintech (Lending)

Stage: Seed

Summary:

Building AI-driven credit risk models for SMB lending; initial pilots with 5 lenders.

Financials:

MRR: $12k; Burn: $60k; Runway: 10 months; Gross Margin: 78%

Traction:

200 paying SMBs; 30% MoM growth; Churn: 3% monthly; CAC: $220; LTV: $2,100

Team:

Founders: Jane Doe (ex-Square), John Lee (ex-Stripe); Team size: 9

Market & Competition:

TAM: $25B; Competitors: Blend, Upstart; Advantage: faster underwriting via proprietary data partnerships

```

Tip: See `examples/text_input_example.py` for a complete end-to-end script and JSON export of results.

## 📊 Output Format

All tools return structured JSON responses with:

```json

{

"startup_name": "Startup Name",

"overall_risk_level": "low|medium|high|critical",

"overall_score": 1-10,

"risk_categories": [

{

"category_name": "Risk Category",

"overall_risk_level": "low|medium|high|critical",

"category_score": 1-10,

"indicators": [

{

"indicator": "Specific risk factor",

"risk_level": "low|medium|high|critical",

"score": 1-10,

"description": "Detailed risk description",

"recommendation": "Mitigation action"

}

],

"summary": "Category summary"

}

],

"key_concerns": ["Top 5 concerns"],

"investment_recommendation": "Investment advice",

"confidence_score": 0.0-1.0,

"analysis_metadata": {

"total_categories_analyzed": 9,

"successful_analyses": 9,

"analysis_timestamp": "2024-01-01T00:00:00Z"

}

}

```

## 🎯 Use Cases

- **Investor Due Diligence** - Comprehensive risk assessment for investment decisions

- **Startup Self-Assessment** - Identify and mitigate key risk areas

- **Portfolio Risk Management** - Assess risk across startup portfolio

- **Accelerator/Incubator Screening** - Evaluate startup applications

- **M&A Risk Analysis** - Assess acquisition targets

- **Research & Analysis** - Academic and industry research on startup risks

## 🏗️ Architecture

### Package Structure

```

pitchlense-mcp/

├── pitchlense_mcp/

│ ├── __init__.py

│ ├── cli.py # Command-line interface

│ ├── core/ # Core functionality

│ │ ├── __init__.py

│ │ ├── base.py # Base classes

│ │ ├── gemini_client.py # Gemini AI integration

│ │ └── comprehensive_scanner.py

│ ├── models/ # Data models

│ │ ├── __init__.py

│ │ └── risk_models.py

│ ├── analyzers/ # Individual risk analyzers

│ │ ├── __init__.py

│ │ ├── market_risk.py

│ │ ├── product_risk.py

│ │ ├── team_risk.py

│ │ ├── financial_risk.py

│ │ ├── customer_risk.py

│ │ ├── operational_risk.py

│ │ ├── competitive_risk.py

│ │ ├── legal_risk.py

│ │ └── exit_risk.py

│ └── utils/ # Utility functions

├── tests/ # Test suite

├── docs/ # Documentation

├── examples/ # Example usage

├── setup.py

├── pyproject.toml

├── requirements.txt

└── README.md

```

### Key Components

1. **Base Classes** (`core/base.py`)

- `BaseLLM` - Abstract base for LLM integrations

- `BaseRiskAnalyzer` - Base class for all risk analyzers

- `BaseMCPTool` - Base class for MCP tools

2. **Gemini Integration** (`core/gemini_client.py`)

- `GeminiLLM` - Main LLM client

- `GeminiTextGenerator` - Text generation

- `GeminiImageAnalyzer` - Image analysis

- `GeminiVideoAnalyzer` - Video analysis

- `GeminiAudioAnalyzer` - Audio analysis

- `GeminiDocumentAnalyzer` - Document analysis

3. **Risk Analyzers** (`analyzers/`)

- Individual analyzers for each risk category

- Consistent interface and output format

- Extensible architecture

4. **Models** (`models/risk_models.py`)

- Pydantic models for type safety

- Structured data validation

- Clear data contracts

## 🔧 Development

### Setup Development Environment

```bash

git clone https://github.com/pitchlense/pitchlense-mcp.git

cd pitchlense-mcp

pip install -e ".[dev]"

pre-commit install

```

### Run Tests

```bash

# Create and activate a virtual environment (recommended)

python3 -m venv .venv

source .venv/bin/activate

# Install dev extras (pytest, pytest-cov, linters)

pip install -e ".[dev]"

# Run tests with coverage and avoid global plugin conflicts

PYTEST_DISABLE_PLUGIN_AUTOLOAD=1 pytest -q -p pytest_cov

```

Notes:

- Coverage reports are written to `htmlcov/index.html` and `coverage.xml`.

- If you see errors about unknown `--cov` options, ensure you passed `-p pytest_cov` when `PYTEST_DISABLE_PLUGIN_AUTOLOAD=1` is set.

### Example Scripts

```bash

python examples/basic_usage.py

python examples/text_input_example.py

```

### Code Formatting

```bash

black pitchlense_mcp/

flake8 pitchlense_mcp/

mypy pitchlense_mcp/

```

### Build Package

```bash

python -m build

```

## 📝 Notes

- All risk scores are on a 1-10 scale (1 = lowest risk, 10 = highest risk)

- Risk levels: low (1-3), medium (4-6), high (7-8), critical (9-10)

- Individual tools can be used independently or combined for comprehensive analysis

- The system handles API failures gracefully with fallback responses

- All tables and structured data are returned in JSON format

- Professional package architecture with proper separation of concerns

## 🤝 Contributing

We welcome contributions! Please see our [Contributing Guide](CONTRIBUTING.md) for details.

1. Fork the repository

2. Create a feature branch

3. Make your changes

4. Add tests

5. Submit a pull request

## 📄 License

This project is licensed under the MIT License - see the [LICENSE](LICENSE) file for details.

## 🆘 Support

- **Documentation**: [https://pitchlense-mcp.readthedocs.io/](https://pitchlense-mcp.readthedocs.io/)

- **Issues**: [GitHub Issues](https://github.com/pitchlense/pitchlense-mcp/issues)

- **Email**: connectamanulla@gmail.com

## 🙏 Acknowledgments

- Google Gemini AI for providing the underlying AI capabilities

- FastMCP for the Model Context Protocol implementation

- The open-source community for inspiration and tools

---

**PitchLense MCP** - Making startup risk analysis accessible, comprehensive, and AI-powered.