Click on "Install Server".

Wait a few minutes for the server to deploy. Once ready, it will show a "Started" state.

In the chat, type

@followed by the MCP server name and your instructions, e.g., "@Optimization MCPallocate a $100k budget across 4 marketing channels to maximize ROI"

That's it! The server will respond to your query, and you can continue using it as needed.

Here is a step-by-step guide with screenshots.

Optimization MCP

Advanced optimization tools for Claude Code - 9 specialized solvers for production use

Version: 2.5.0 (All 4 Enhancements Complete) Status: Production Ready (9 Tools + 1 Orchestration Skill)

Quick Start (60 Seconds)

Want to try it immediately? Here's the fastest path:

1. Install Dependencies (10 seconds)

2. Test It Works (10 seconds)

Run: python test_basic.py

Expected output:

3. Use in Claude Code (30 seconds)

Add to ~/.claude.json:

Restart Claude Code, then try:

4. Next Steps (10 seconds)

Read full documentation below

Explore all 9 tools

Overview

The Optimization MCP provides constraint-based optimization capabilities that integrate seamlessly with your existing Monte Carlo MCP. Find optimal resource allocations, robust solutions across scenarios, and make data-driven decisions under uncertainty.

Key Features

Deep MC Integration: Every tool has native Monte Carlo awareness - use percentile values, expected outcomes, or full scenario distributions

Production Solvers: PuLP (LP/MILP), SciPy (nonlinear), CVXPY (quadratic), NetworkX (network flow)

High Performance: NetworkX provides 10-100x speedup for logistics/routing problems (1K-10K variables)

Zero-Friction Workflows: Optimization outputs feed directly into Monte Carlo validation tools

Open Source: No commercial licenses required (Gurobi/CPLEX not needed)

Production Ready: Internally tested, comprehensive error handling, helpful diagnostics

Comprehensive Coverage: Network flow, Pareto frontiers, stochastic programming, column generation

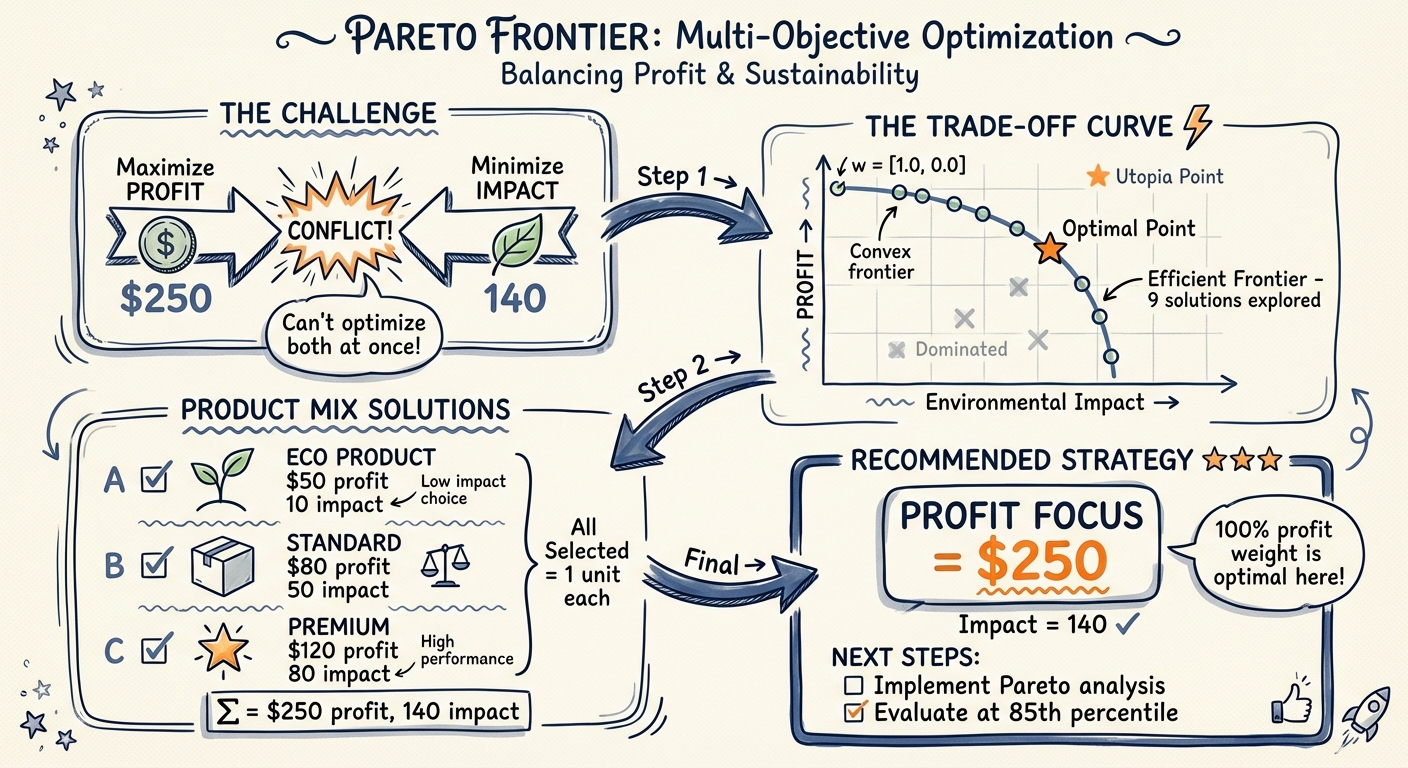

Pareto Frontier Visualization

Multi-objective optimization balancing conflicting goals (profit vs sustainability):

This visualization demonstrates how the Pareto frontier tool explores trade-offs between competing objectives, helping you make strategic decisions across multiple optimal solutions.

Installation

Via Plugin Marketplace (Recommended)

Manual Installation

Auto-Setup: The setup.sh script automatically creates a virtual environment and installs all dependencies.

Important Disclaimers

Software Warranty

This software is provided "as is" under the MIT License, without warranty of any kind, express or implied. The authors are not liable for any damages arising from the use of this software. Always validate optimization results before implementation.

Business Decision Notice

Optimization results are mathematical models based on input data and assumptions. While algorithms are rigorously tested, real-world decisions require:

Validation of results with domain experts

Sensitivity analysis for critical parameters

Testing with historical data before deployment

Understanding of model limitations and assumptions

Financial Advice Disclaimer

The portfolio optimization tool is for educational and analytical purposes only. It does not constitute financial, investment, or professional advice. Consult qualified financial advisors before making investment decisions. Past performance and model outputs do not guarantee future results.

Accuracy and Validation

All optimization tools undergo comprehensive internal testing and validation, but users should:

Verify results independently for critical applications

Test with known problems before production use

Validate assumptions and input data quality

Review solver status and warnings carefully

Consider multiple scenarios and sensitivity analysis

Recommendation: Start with non-critical applications, validate thoroughly, then scale to production use.

Tools

1. optimize_allocation

Purpose: Resource allocation under constraints (budget, time, capacity)

Use Cases:

Marketing budget across channels

Production capacity across products

Project selection with resource limits

Ingredient formulation for beverages/foods

Example:

Monte Carlo Integration:

Parameters:

objective: Dict withitems(list) andsense("maximize"/"minimize")resources: Dict of resource limits (e.g.,{"budget": {"total": 100000}})item_requirements: List of dicts with resource requirements per itemconstraints: Optional additional constraintsmonte_carlo_integration: Optional MC integration (3 modes: percentile, expected, scenarios)solver_options: Optional (time_limit,verbose)

Returns:

status: "optimal", "infeasible", "unbounded", or "error"objective_value: Optimal valueallocation: Dict of selected items (1 = selected, 0 = not)resource_usage: Utilization stats for each resourceshadow_prices: Marginal value of relaxing each constraintmonte_carlo_compatible: Output formatted for MC validation

Multi-Objective Optimization

NEW in v1.1.0: Optimize for multiple competing objectives with weighted scalarization.

Use Cases:

Balance profit and sustainability

Trade off return vs. risk

Optimize cost and quality simultaneously

Any multi-criteria decision problem

Example:

Requirements:

At least 2 objective functions required

Weights must sum to 1.0 (within 0.01 tolerance)

Each weight must be between 0 and 1

Each function has its own

itemslist withnameandvalue

Backward Compatible: Single-objective format still works exactly as before.

Enhanced Constraints

NEW in v2.0.0: Advanced constraint types for complex decision logic.

Constraint Types:

1. Conditional (If-Then):

2. Disjunctive (OR - At Least N):

3. Mutual Exclusivity (Exactly N):

Combined Example:

Use Cases:

Product bundling rules

Technology dependency chains

Strategic option selection

Regulatory compliance constraints

2. optimize_robust

Purpose: Find robust solutions that work well across Monte Carlo scenarios

Use Cases:

Allocation that works in 85%+ of scenarios

Worst-case optimization

Risk-constrained decisions

Example:

Parameters:

objective,resources,item_requirements: Same as optimize_allocationmonte_carlo_scenarios: Dict withscenarioslist from MC outputrobustness_criterion: "best_average", "worst_case", or "percentile"risk_tolerance: Float (0-1), e.g., 0.85 = works in 85% of scenariosconstraints,solver_options: Optional

Returns:

allocation: Robust allocation decisionrobustness_metrics: Performance statistics across scenariosoutcome_distribution: List of outcomes for validationmonte_carlo_compatible: Output for MC tools

3. optimize_portfolio

NEW in v2.0.0: Portfolio optimization with risk-return tradeoffs using quadratic programming.

Purpose: Optimize investment portfolio allocation considering correlations and risk

Use Cases:

Investment portfolio allocation

Asset selection with risk-return tradeoffs

Sharpe ratio maximization

Efficient frontier construction

Optimization Objectives:

Sharpe Ratio: Maximize (return - risk_free) / risk

Min Variance: Minimize portfolio risk for target return

Max Return: Maximize return for target risk

Example 1: Sharpe Ratio Optimization:

Example 2: Minimum Variance:

Example 3: Maximum Return:

Parameters:

assets: List of{"name": str, "expected_return": float}covariance_matrix: N×N matrix of asset return covariancesoptimization_objective:"sharpe","min_variance", or"max_return"risk_free_rate: Risk-free rate for Sharpe (default: 0.02)constraints: Optional:max_weight: Max weight per asset (e.g., 0.30 = 30%)min_weight: Min weight per asset (e.g., 0.05 = 5%)target_return: Required formin_varianceobjectivetarget_risk: Required formax_returnobjectivelong_only: Prevent short selling (default: True)

monte_carlo_integration: Optional MC integrationsolver_options: Optional solver settings

Returns:

status: Optimization statusweights: Dict of optimal portfolio weights (sum to 1.0)expected_return: Portfolio expected returnportfolio_variance: Portfolio variance (risk²)portfolio_std: Portfolio standard deviation (risk)sharpe_ratio: (return - rf) / stdassets: Asset-level details with risk contributionsmonte_carlo_compatible: MC validation output

Solver: CVXPY with SCS (handles quadratic objectives and constraints)

4. optimize_schedule

NEW in v2.0.0: Task scheduling with dependencies and resource constraints.

Purpose: Optimize project schedules considering task dependencies, resource limits, and temporal constraints

Use Cases:

Project scheduling (RCPSP)

Job shop scheduling

Task prioritization with deadlines

Resource allocation over time

Optimization Objectives:

Minimize Makespan: Complete project as fast as possible

Maximize Value: Prioritize high-value tasks within time budget

Example 1: Software Project Schedule:

Example 2: With Deadlines:

Parameters:

tasks: List of tasks with:name: Task identifierduration: Time units requiredvalue: Task value/priority (optional, for maximize_value)dependencies: List of prerequisite task names (optional)resources: Resource requirements per time unit (optional)

resources: Available resources per time periodtime_horizon: Total scheduling windowconstraints: Optional temporal constraints:Deadline: Task must finish by time T

Release: Task cannot start before time T

Parallel limit: Max N tasks simultaneously

optimization_objective:"minimize_makespan"or"maximize_value"monte_carlo_integration: Optional MC for uncertain durationssolver_options: Optional solver settings

Returns:

status: Optimization statusschedule: Dict mapping task → start_timemakespan: Project completion time (for minimize_makespan)total_value: Sum of scheduled task values (for maximize_value)resource_usage: Resource utilization timelinecritical_path: Task sequence determining makespantasks: Task-level details with critical path markersmonte_carlo_compatible: MC validation output

Solver: PuLP with CBC (MILP for task-time assignment)

5. optimize_execute

NEW in v2.1.0: Custom optimization with automatic solver selection and flexible problem specification.

Purpose: Power user tool for rapid prototyping and custom optimization problems

Use Cases:

Custom optimization formulations not fitting standard templates

Rapid prototyping of new optimization problems

When you know the mathematical form and want automatic solver selection

Educational/research applications

Key Features:

Auto-Solver Selection: Automatically detects and selects best solver (PuLP/SciPy/CVXPY)

Flexible Specification: Dict-based problem definition

All Solvers Accessible: Can override auto-detection to force specific solver

Example 1: Simple Knapsack Problem:

Example 2: With Solver Override:

Parameters:

problem_definition: Dict with:variables: List of{"name": str, "type": "continuous"|"integer"|"binary", "bounds": (lower, upper)}objective:{"coefficients": {var: coeff}, "sense": "maximize"|"minimize"}constraints: List of{"coefficients": {var: coeff}, "type": "<="|">="|"==", "rhs": number}

auto_detect: Auto-select best solver (default: True)solver_preference: Override with"pulp","scipy", or"cvxpy"monte_carlo_integration: Optional MC integrationsolver_options: Optional (time_limit,verbose)

Returns:

status: Optimization statussolver_used: Which solver was selectedobjective_value: Optimal valuesolution: Dict of variable valuessolve_time_seconds: Solve timeproblem_info: Problem statisticsshadow_pricesordual_values: Sensitivity information (solver-dependent)monte_carlo_compatible: MC validation output

Auto-Detection Logic:

Has binary/integer variables → PuLP (CBC)

Continuous linear → PuLP (default)

Can override with

solver_preferenceparameter

When to Use:

✅ You have a custom problem not fitting standard templates

✅ You want to prototype quickly with dict specification

✅ You need access to all 3 solvers from one interface

✅ You're comfortable with mathematical formulation

When NOT to use:

❌ Standard allocation → Use optimize_allocation instead

❌ Portfolio → Use optimize_portfolio instead

❌ Scheduling → Use optimize_schedule instead

Solver: Auto-selected (PuLP/SciPy/CVXPY) or manual override

Why optimize_execute is Your "Escape Hatch"

The Flexibility Layer: While specialized tools cover 90% of use cases, optimize_execute is deliberately designed for the other 10%.

When specialized tools fit (use these first):

Budget allocation →

optimize_allocationPortfolio →

optimize_portfolioScheduling →

optimize_scheduleNetwork routing →

optimize_network_flowMulti-objective trade-offs →

optimize_pareto

When you need custom formulation (use optimize_execute):

Custom knapsack variants

Unusual constraint types

Rapid prototyping of new problems

Educational/research applications

Any problem not fitting standard templates

Think of it as:

Specialized tools = High-level API (easy, opinionated, 90% of cases)

optimize_execute = Low-level API (flexible, general, 10% of cases)

Example - Custom Multi-Dimensional Knapsack:

You get:

Auto-detection of solver (PuLP for this binary problem)

All the power of mathematical programming

None of the boilerplate of specialized tools

Monte Carlo integration still available

Both have their place - use specialized tools when they fit (easier, better validation), optimize_execute when you need full control.

6. optimize_network_flow

NEW in v2.2.0: Network flow optimization with specialized NetworkX algorithms for 10-100x speedup.

Purpose: Solve network flow problems (min-cost flow, max-flow, assignment)

Use Cases:

Supply chain routing (warehouse → customer distribution)

Transportation logistics (minimize shipping costs)

Assignment problems (workers to tasks, machines to jobs)

Maximum throughput/capacity problems

Key Features:

High Performance: NetworkX specialized algorithms 10-100x faster than general LP

Auto-Solver Selection: NetworkX for pure network flow, PuLP fallback for complex constraints

Bottleneck Analysis: Identifies capacity-constrained edges

Node Balance Tracking: Flow conservation verification at each node

Example 1: Supply Chain Min-Cost Flow:

Example 2: Maximum Flow:

Example 3: Assignment Problem:

When to Use:

✅ Pure network flow problems (routing, logistics, assignment)

✅ Large-scale problems (1K-10K variables) where speed matters

✅ Supply chain optimization with transportation costs

✅ Capacity/throughput maximization

When NOT to use:

❌ Multi-commodity flow (different product types) → Use optimize_allocation

❌ Complex side constraints beyond flow conservation → optimize_execute with PuLP

Solver: NetworkX (primary) with PuLP fallback for complex cases Performance: <0.001s for 100 nodes, <2s for 1000 nodes

7. optimize_pareto

NEW in v2.3.0: Pareto multi-objective optimization - explore full trade-off frontier.

Purpose: Generate complete Pareto frontier showing all trade-offs between conflicting objectives

Use Cases:

Strategic planning (profit vs sustainability vs risk)

Design optimization (cost vs quality vs time)

Product selection (revenue vs customer satisfaction)

Multi-criteria decision support

Key Features:

Full Frontier Generation: 20-100 non-dominated solutions (not just one weighted point)

Knee Point Recommendation: Automatically identifies best balanced solution

Trade-Off Analysis: Quantifies marginal rates of substitution between objectives

Mixed Senses: Handles maximize + minimize objectives simultaneously

Example: Profit vs Sustainability Trade-Off:

When to Use:

✅ Don't know the "right" trade-off weights upfront

✅ Need to show executives/stakeholders multiple options

✅ Want to understand sensitivity to objective priorities

✅ Multi-criteria decision problems

When NOT to use:

❌ Already know exact weights → Use optimize_allocation with multi-objective

❌ Single objective → Use optimize_allocation

Solver: PuLP (solves weighted sums systematically) Performance: ~0.5-2s for 20 frontier points

Scalability Guidelines

Understanding the performance characteristics of each tool helps you choose the right approach and set realistic expectations.

optimize_allocation

Recommended limits:

Items: <500 (optimal performance)

Resources: <100

Binary/integer variables: <1000

Constraints: <1000

Performance characteristics:

Uses PuLP with CBC solver (branch-and-cut MIP)

Small problems (<50 items): <1 second

Medium problems (50-500 items): <10 seconds

Large problems (500-1000 items): <60 seconds

When to use: Budget allocation, resource assignment, selection problems

optimize_robust

Recommended limits:

Items: <100 (candidate generation is combinatorial)

Scenarios: <1000

Total evaluations (items × scenarios): <100,000

Performance characteristics:

Generates candidate allocations, evaluates across scenarios

Evaluation time grows linearly with scenarios

Candidate generation can be exponential in items

When to use: Risk-aware allocation under uncertainty

optimize_portfolio

Recommended limits:

Assets: <500

Covariance matrix: N×N must fit in memory (~500×500 = 2MB)

Performance characteristics:

Uses CVXPY with SCS/OSQP solvers (quadratic programming)

Small portfolios (<50 assets): <1 second

Medium portfolios (50-200 assets): <5 seconds

Large portfolios (200-500 assets): <30 seconds

When to use: Investment portfolio optimization, risk-return trade-offs

optimize_schedule

Recommended limits:

Tasks: <50

Time horizon: <100 periods

Total time-indexed variables (tasks × horizon): <5000

Performance characteristics:

Uses time-indexed formulation (binary variable per task-time pair)

Variables = tasks × time_horizon

Small projects (<20 tasks): <10 seconds

Medium projects (20-50 tasks): <60 seconds

When to use: Project scheduling, resource-constrained planning

optimize_network_flow

Recommended limits:

Nodes: <10,000

Edges: <100,000

Performance characteristics:

Uses NetworkX specialized algorithms (network simplex, Edmonds-Karp)

Exploits network structure for 100-5000x speedup vs general LP

Small networks (<100 nodes): <0.1 seconds

Medium networks (100-1000 nodes): <1 second

Large networks (1000-10000 nodes): <10 seconds

When to use: Transportation, logistics, routing, assignment problems

optimize_pareto

Recommended limits:

Frontier points: 20-100 (more points = finer trade-off curve)

Items: Same as optimize_allocation

Objectives: 2-4 (visualization becomes difficult beyond 3)

Performance characteristics:

Solves one optimization per frontier point

Total time ≈ single optimization × number of points

20 points typically takes 10-30 seconds

When to use: Multi-objective trade-off analysis, exploring decision space

optimize_stochastic

Recommended limits:

Scenarios: <200 (extensive form size scales linearly)

First-stage variables: <500

Second-stage variables: <500

Total problem size: n₁ + S×n₂ < 100,000

Performance characteristics:

Uses 2-stage extensive form (single large LP)

Problem size = first_stage + scenarios × second_stage

50 scenarios, 100 vars/stage: ~5 seconds

200 scenarios, 200 vars/stage: ~60 seconds

When to use: Sequential decisions with uncertainty revelation (inventory, capacity planning)

optimize_column_gen

Recommended limits:

Master problem variables: <10,000 (framework ready, user implements pricing)

Iterations: <100

Performance characteristics:

Framework for large-scale problems (>1000 variables)

Performance depends on user-provided pricing subproblem

Currently returns with initial columns (placeholder pricing)

When to use: Very large problems, cutting stock, crew scheduling (requires custom pricing)

optimize_execute

Recommended limits:

Variables: Depends on auto-detected solver

PuLP (LP/MIP): <10,000 variables

SciPy (nonlinear): <1,000 variables

CVXPY (QP): <5,000 variables

Performance characteristics:

Auto-detects problem type and selects appropriate solver

Performance matches selected backend solver

When to use: Custom problems not covered by specialized tools

Performance Tips

Start small: Test with 10-20% of full problem size first

Use network_flow for network problems: 100-5000x faster than general LP

Reduce scenarios: 50 scenarios often sufficient for stochastic problems

Use robust over stochastic for simple cases: Faster evaluation, no extensive form

Pareto frontier: 20 points usually sufficient to see trade-off curve

Check solver_options: Set

time_limitto prevent runaway solves

When You Hit Scale Limits

If your problem exceeds recommended limits:

Decomposition: Break into smaller subproblems

Aggregation: Group similar items/resources

Sampling: Use subset of scenarios for stochastic

Heuristics: Use optimize_robust with candidate sampling

Column generation: Use optimize_column_gen for very large problems

Commercial solvers: Consider Gurobi/CPLEX for 10x+ speedup (not included)

Monte Carlo Integration Patterns

This MCP has deep Monte Carlo integration - every tool can work with uncertainty. However, tools use different patterns based on their needs.

Pattern Summary

Tool | MC Parameter | Modes Supported | Purpose |

optimize_allocation | monte_carlo_integration | percentile, expected | Use MC values in objective |

optimize_robust | monte_carlo_scenarios | scenarios only | Evaluate across all scenarios |

optimize_portfolio | monte_carlo_integration | percentile, expected | Use MC returns/covariance |

optimize_schedule | monte_carlo_integration | percentile, expected | Use MC durations |

optimize_execute | monte_carlo_integration | percentile, expected | Use MC coefficients |

optimize_network_flow | monte_carlo_integration | percentile, expected | Use MC costs/capacities |

optimize_pareto | monte_carlo_integration | percentile, expected | Use MC objective values |

optimize_stochastic | scenarios | scenarios only | Model uncertainty explicitly |

Pattern Type A: Percentile/Expected (Most Tools)

Used by: allocation, portfolio, schedule, execute, network_flow, pareto

Purpose: Extract specific values (P10/P50/P90 or expected) from MC output and use in optimization

Example:

Modes:

"percentile": Use P10/P50/P90 values from distributionP10 = Conservative (pessimistic)

P50 = Base case (median)

P90 = Optimistic

"expected": Use mean values from distribution

What happens: Tool extracts specified percentile/expected values from mc_output and uses them in optimization

Pattern Type B: Scenarios (Robust & Stochastic)

Used by: optimize_robust, optimize_stochastic

Purpose: Evaluate decisions across ALL scenarios (not just one percentile)

Example for optimize_robust:

Example for optimize_stochastic:

What happens: Tool evaluates optimization across all scenarios

optimize_robust: Tests candidate allocations against all scenariosoptimize_stochastic: Models uncertainty explicitly in 2-stage formulation

When to Use Which Pattern

Use Pattern A (percentile/expected) when:

You want a single deterministic optimization

You're comfortable picking P10/P50/P90 upfront

You want fast solve times

Example: "Allocate budget using median ROI values"

Use Pattern B (scenarios) when:

You want robustness across uncertainty

You care about worst-case or risk tolerance

You need sequential decisions with uncertainty revelation

Example: "Find allocation that works in 85% of scenarios"

Common Workflows

Workflow 1: Conservative Planning

Workflow 2: Robust Optimization

Workflow 3: Stochastic Sequential Decisions

Migration Guide

If you're using the old pattern and want to update:

Old (still works):

New (with MC):

Backward compatible: All tools work without MC parameters (deterministic mode)

Schema Grammar Reference

Common data structures used across multiple tools. Learn once, use everywhere.

Resource Definition

Used in: optimize_allocation, optimize_schedule, optimize_pareto, optimize_stochastic, optimize_robust

Format:

Examples:

Item Requirements

Used in: optimize_allocation, optimize_robust, optimize_pareto

Format:

Examples:

Important: Resource names in requirements must match resource names in resources dict

Objective Specification

Used in: optimize_allocation, optimize_robust, optimize_pareto

Single Objective Format:

Multi-Objective Format (allocation only):

Example:

Constraint Specification

Used in: optimize_allocation, optimize_schedule

Format:

Examples:

Network Specification

Used in: optimize_network_flow

Format:

Example:

Node types:

Source:

supply > 0(produces flow)Sink:

demand > 0(consumes flow)Transshipment: Neither supply nor demand (passes flow through)

Solver Options

Used in: All tools

Format:

Example:

Usage:

Canonical Workflows

Workflow 1: Optimize → Validate → Robustness Test

Find optimal allocation, validate with Monte Carlo, test assumption robustness.

Workflow 2: MC Scenarios → Robust Optimization

Generate scenarios with Monte Carlo, optimize for robustness.

Technical Architecture

Solvers

Solver | Type | Best For | Scale |

PuLP + CBC | LP/MILP | Resource allocation, scheduling, formulation | Up to 10,000 vars |

SciPy | Nonlinear | Continuous optimization with bounds/constraints | 10-1000 vars |

File Structure

Performance Targets

Problem Size | Target Time | Use Case |

Small (< 50 vars) | < 1 sec | Formulation problems |

Medium (50-500 vars) | < 10 sec | Resource allocation |

Large (500-1000 vars) | < 60 sec | Complex scheduling |

Troubleshooting

MCP Not Loading

Check configuration:

grep -A5 '"optimization-mcp"' ~/.claude/config/mcp-profiles.jsonVerify server.py is executable:

ls -l ~/.claude/mcp-servers/optimization-mcp/server.pyCheck logs:

tail -f /tmp/optimization-mcp.log

Infeasible Problems

If you get status: "infeasible":

Check that at least one item fits within resource limits

Verify constraints aren't contradictory

Use smaller problem to debug

Slow Solving

If optimization takes > 60 seconds:

Reduce problem size (fewer items/constraints)

Add

solver_options: {"time_limit": 30}to stop earlyConsider breaking into subproblems

Roadmap

Week 2 (Next Steps)

Tool 3:

optimize_portfolio- Portfolio optimization with Sharpe ratioTool 4:

optimize_schedule- Task scheduling with dependenciesCVXPY integration for quadratic objectives

Week 3

Tool 5:

optimize_execute- Custom workflows with code executionOrchestration skill:

robust-optimization- End-to-end automationPerformance benchmarks and optimization

Examples

Example 1: Marketing Budget Allocation

Dependencies

mcp >= 0.9.0 - Model Context Protocol

pulp >= 2.7.0 - Linear/integer programming

scipy >= 1.16.0 - Scientific computing

numpy >= 2.3.0 - Numerical arrays

pytest >= 7.0.0 - Testing framework

License

Part of Claude Code MCP ecosystem. Use responsibly.

Support

Issues: Report problems in your Claude Code setup

Documentation: See plan file at

~/.claude/plans/resilient-frolicking-wreath.mdExamples: Check

examples/directory for complete workflows

Week 1 Status: ✓ Production Ready with 2 Core Tools

Next: Week 2 - Portfolio optimization and scheduling tools